Western Australia

In this snapshot

Western Australia is estimated to receive $7,257 million in GST in 2024–25. This would be an increase of $838 million compared to 2023–24. The change reflects the application of the GST relativity floor, which has increased from 0.70 in 2023–24 to 0.75 in 2024–25. It also reflects the growth in the GST pool.

GST distribution in 2024-25

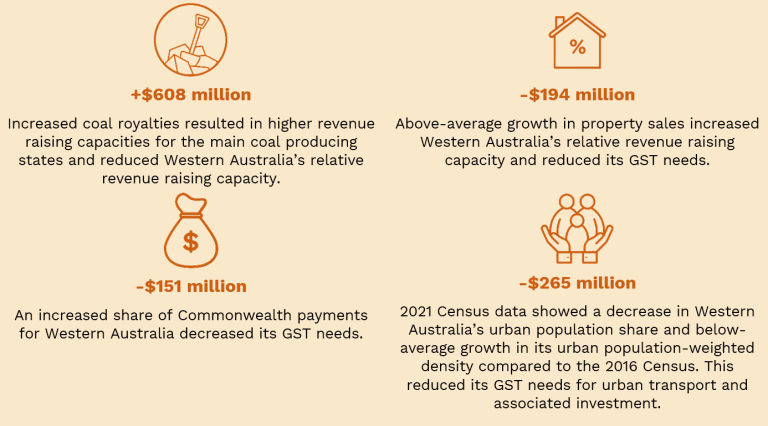

Key factors that affected Western Australia’s GST needs in 2024-25 compared with 2023-24

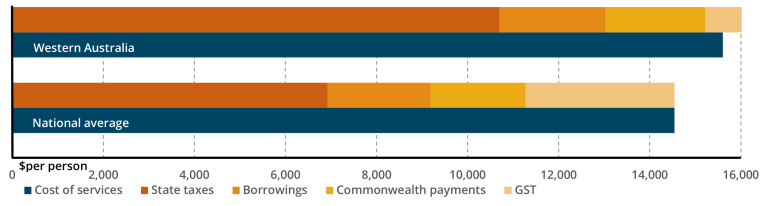

How Western Australia compared with other states and territories

Western Australia’s capacity to raise revenue from its own taxes is higher than the national average. For example:

The characteristics of the people living in Western Australia mean that the cost of providing government services is higher than the national average. For example:

Overall, the above-average revenue raising capacity of Western Australia outweighs its above-average cost of providing services. Western Australia receives a per person GST distribution below the national average, equal to the floor of 0.75.

How the GST is distributed

The Commonwealth Grants Commission provides independent advice to the Australian Government on how GST should be distributed among the states. In doing this, the Commission takes account of states’ different abilities to raise revenue and their different costs in providing services.

The amount of revenue each state can raise differs because it depends on things like the value of mining production, property transactions and taxable payrolls. The cost of providing services varies too, based on things like a state’s size, its geography, where its residents live and other socio-demographic characteristics, for example, age, health, income, and education.

Changes to the GST distribution in 2024–25 reflect the 2018 GST legislated arrangements. These include implementation of a GST relativity floor below which no state’s GST revenue sharing relativity can fall and Commonwealth top-ups to the GST pool. The Commonwealth also makes separate transitional no worse off payments to the states.